[Infographic] What Should Enterprises Do When Increasing the Regional Minimum Wage?

[Infographic] What Should Enterprises Do When Increasing the Regional Minimum Wage?

– Ngo Thi Ngoc –

Articles posted at Saigon Time: https://thesaigontimes.vn/nhung-dieu-can-luu-y-khi-tang-luong-toi-thieu/

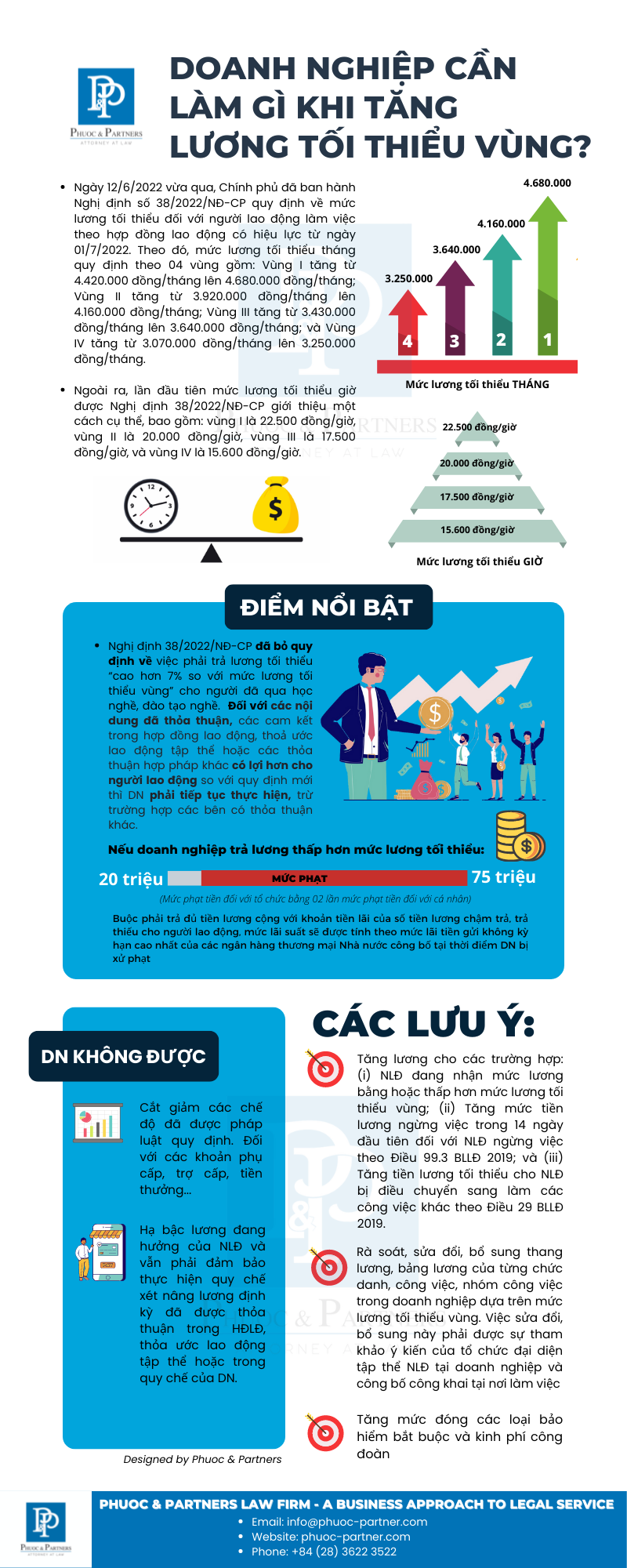

On 12 June 2022, the Government issued Decree No. 38/2022/ND-CP, stipulating the minimum wages for employees working under labour contract, effective from 1 July 2022. Accordingly, the minimum monthly wage is regulated by 04 regions including: Region I increased from 4,420,000 VND/month to 4,680,000 VND/month; Region II increased from 3,920,000 VND/month to 4,160,000 VND/month; Region III increased from 3,430,000 VND/month to 3,640,000 VND/month; and Region IV increased from 3,070,000 VND/month to 3,250,000 VND/month.

Previously, according to the provisions of Article 5.1 of Decree 90/2019/ND-CP, the regional minimum wage is the lowest salary that enterprises use as a basis for negotiating and paying employees who perform the simplest work under normal working conditions, ensuring enough normal working hours in a month and completing agreed labour norms or jobs, ensuring that the following 02 conditions are satisfied: (1) Not be lower than the regional minimum wages for unskilled employees doing the simplest duties; and (2) Be at least 7% higher than the regional minimum wages for skilled employees who have received vocational training. Up to Decree 38/2022/ND-CP, a notable change related to the minimum wage is the removal of the provision that the minimum wages are at least 7% higher than the regional minimum wages for skilled employees who have received vocational training. The minimum monthly wages according to Decree 38/2022/ND-CP is only generally stipulated as the lowest salary as a basis for negotiating and paying salaries to employees applying monthly salary. When salary is paid monthly, the enterprise must ensure that the salary would be paid according to the job or title of the employee, who has worked for all normal working hours in the month and achieved the agreed labour norm or assigned tasks, but not lower than the minimum monthly salary.

In addition, this is the first time that the minimum hourly salary is specifically introduced by Decree 38/2022/ND-CP, including: Region I is 22,500 VND/hour, Region II is 20,000 VND/hour, and Region III is 17,500 VND/hour, and Region IV is 15,600 VND/hour. In fact, the hourly minimum wage has been stipulated in the Labour Code 2012 and the Labour Code 2019, but the previous Decrees only provided detailed instructions on the monthly minimum wage without any specific regulations on the hourly minimum wage. Accordingly, the minimum hourly wage is regulated to protect all groups of employees, especially those working in flexible, informal, or part-time jobs in small businesses, households, with low salary, etc. Similar to the minimum monthly wages applied to employees who are receiving salaries in the form of the monthly payment, minimum hourly wages are applied to employees who are receiving salaries in the form of hourly salaries. For employees who are receiving salaries under other payment methods such as a weekly or daily salary, a piece-rate pay, or a fixed pay, the salary paid to employees under these payment methods will have to be converted to monthly or hourly salary, provided that such salary is not lower than the monthly minimum wage or the minimum hourly wage as mentioned above. This conversion of the monthly minimum wage or the hourly minimum wage is selected by the employer, the hourly minimum wage will be calculated by dividing the monthly minimum wage by the number of working days/month and the number of hours work/day to get results.

For small and medium-sized enterprises, the increase in the regional minimum wages will not really have a big impact on businesses. However, for large-scale enterprises, especially those in the manufacturing sector, with many unskilled employees, an increase in the cost of paying the regional minimum wages will have a great impact on the financial situation of enterprises. Therefore, when the new regional minimum wages are promulgated by the Government, enterprises need to carry out a number of specific reviews and adjustments as follows:

- Firstly, when the current regional minimum wages increase, the lowest salary that enterprises have to pay to employees must also increase accordingly. Thus, the increase in the regional minimum salary makes the salary costs of enterprises also increase. Specifically, enterprises will have to pay attention to increase salaries for the following cases: (i) Increase salaries for employees who are receiving salary equal to or lower than the regional minimum wages as prescribed; (ii) Increase the salary for stopping work in the first 14 days for any employees who stop working according to Article 99.3 of the Labour Code 2019; and (iii) Increase the minimum wages for employees who are transferred to other jobs under Article 29 of the Labour Code 2019.

- Secondly, regarding the salary issue, enterprises should review, amend and supplement the salary scale and salary table of each job title, job group in the enterprise based on the current regional minimum salary to be consistent with the new regulations mentioned above. This amendment and supplement must be consulted with the representative organization of the collective of employees at the enterprise and publicly announced at the workplace of the employees before implementation. If the enterprise pays salary lower than the minimum salary, the enterprise will be fined from VND 20 million to VND 75 million according to the provisions of Articles 17.3 and 17.5 (a) Decree 12/2022/ND-CP. In addition, the enterprise is also required to pay the full salary plus the interest on the late payment or insufficient payments of salary, which are calculated at the highest rate of the demand deposit interest rates publicly quoted by state-owned commercial banks on the date of penalty imposition.

- Third, adjusting salary scale and table following the increase of regional minimum wage would result in higher payment of compulsory insurances. Under the applicable laws, the salary upon which social insurance payment is based must not be lower than the regional minimum wage at the time of payment, for employees of the most ordinary role or title in normal working condition.[1].

- Fourth, enterprises should simultaneously review agreements in labour contracts, collective labour agreements, and internal labour regulations to adjust and supplement accordingly; Enterprises shall not remove or reduce salary regimes when employees work overtime, work at night, compensation in-kind, and other regimes in accordance with the labour law to compensate for the increased costs due to salary adjustments according to the new regulations. With regard to the agreed terms, commitments in the labour contract, collective labour agreement, or other legal agreements that are more favourable to employees than the new regulations, the enterprises must continue to execute those terms, unless otherwise agreed by the parties. In particular, the contents related to the salary regime paid to any employees who perform jobs or titles that require vocational training or vocational training are at least 7% higher than the current minimum wages in enterprises, unless otherwise agreed by the two parties in accordance with the labour law.[2]

- Fifth, when an enterprise adjusts the monthly minimum wage and the hourly minimum wage for employees working under labour contracts as prescribed in Decree 38/2022/ND-CP, enterprises are also not allowed to reduce the regimes as prescribed by law. With regard to allowances, subsidies, bonuses, etc., prescribed by the enterprises, the enterprise must comply with the agreement in the contract, collective labour agreement, or in the internal regulations as prescribed by law. In addition to adjusting the minimum wages, enterprises will not be allowed to lower the salary level that employees are enjoying and must ensure the implementation of the regulation on periodical salary increase as agreed in the labour contracts, collective labour agreements, or in the internal regulations of the enterprise.[3]

According to Maslow’s classic hierarchy of needs, employees’ most basic needs must be satisfied by good and fair pay, as well as other benefits such as salary increase, bonuses, etc. to maintain their peace of mind and focus on work; only then will businesses achieve business goals and sustainable development, avoid unnecessary fluctuating employee turnover rate that wastes their time and money on new recruitment and retraining. In fact, this cost is even higher than the cost of raising employee salaries. We can see that raising the minimum wages not only benefits employees but also indirectly motivates the recovery and development of enterprises. In the past two years of 2020 and 2021, due to the direct impacts of the Covid-19 pandemic and prolonged social distancing, as well as the need to altogether alleviate difficulties businesses were then facing during that challenging time, the regional minimum wages were not increased, but remained in compliance with the wages as announced in Decree 90/2019/ND-CP. Therefore, the regional minimum wages adjusted in Decree 38/2022/ND-CP this time are necessary to catch up with the significantly increasing rate of inflation and support the employees in overcoming their difficulties, which further make them securely attached to their current employers, and at the same time help enterprises boost labour productivity, recover and develop their production and business..

[1] Article 6.2.6 of Decision 595/QĐ-BHXH in 2017

[2] Article 1.1 (b) Official Dispatch 2086/BLDTBXH-TLDLDVN on directing the implementation of Decree No. 38/2022/ND-CP on minimum salary

[3] Article 7,8 Official Dispatch 516/LDLD-CSPL on guiding and supervising the adjustment of minimum wage in 2022